Customers will leave you—that’s the sad reality businesses need to understand. But do they really need to go? What are they leaving for? Churn rate can answer these questions and help you understand customer retention and business growth.

Read on to understand what churn rate is, why it is important, and how you can calculate it.

Table of Contents

ToggleWhat is the Churn Rate?

Churn rate (also known as customer churn or attrition rate) refers to the percentage of customers who stop using your product or service over a specific period. Simply put, it is a measure of customers lost by you. If you are running a subscription service, for example, it tells you how many people have unsubscribed from your service at a given time.

High churn rates are red flags. A higher customer churn rate indicates that the business has been losing customers faster than it could replace them, which will harm your business growth. On the contrary, a low churn means that you can keep most of your customers happy and satisfied.

Importance of Churn Rate

Understanding your churn rate helps you answer some critical questions about your business:

How well are you retaining your customers?

Are they happy with your product or service?

If not, Do you need to improve customer support, product quality, or pricing?

Is your growth steady and sustainable?

In a subscription-based model, the customer churn is in direct proportion to revenue. When you are losing customers faster than you are gaining, it will hamper the growth of the business. So for sustainable growth in the long term maintaining a good is important.

How to Calculate Churn Rate?

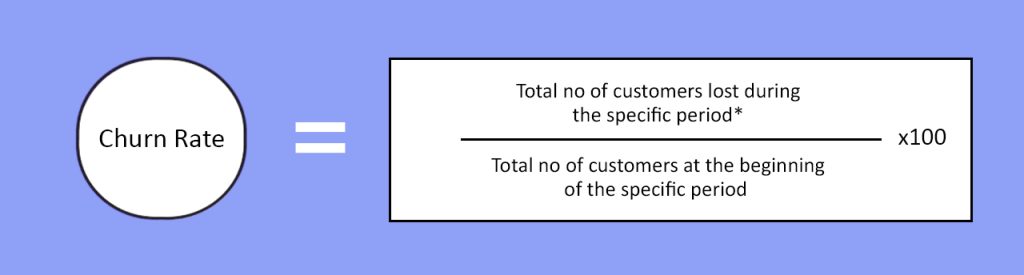

Calculation of the churn rate is straightforward.

Here’s the basic formula:

*( Total number of customers at the start of the period- Total number of customers at the end of the period)

Step-by-Step Calculation

1. Identify the time period where you want to calculate the customer churn, be it month, quarter or year.

2. Determine how many customers at the beginning of the period and the end of the period and minus both to get the no of customers left during that period.

3. Find the no of customers at the start of the period for the baseline number.

4. Put all the numbers in the formula and multiply that by 100.

Example Calculation

Let’s say you started the month with 1,000 subscribers, and by the end of the month, 50 of them cancelled their subscriptions. Your churn rate would be:

1000-950

= ————– * 100

1000

This means your churn rate for the month is 5%.

Different Types of Churn Rates

It is important to understand the different natures of churn rates to determine the most valuable one for the growth of your company. Here are a few different types of customer churn:

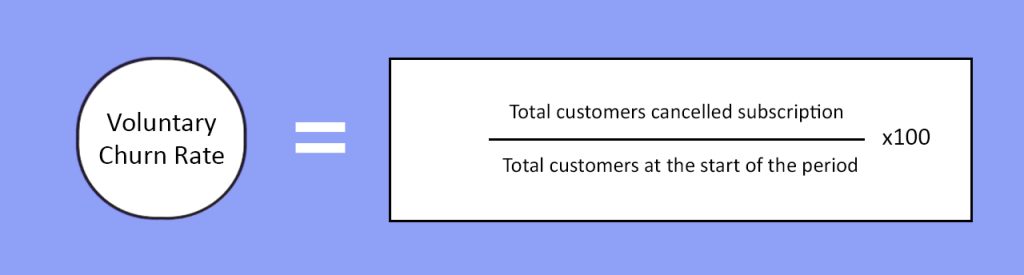

Voluntary Churn

The most common one, is where customer willingly choose to cancel or terminate their contract or subscription. Reasons can be dissatisfaction, switching to competitors, and no proper brand support.

Involuntary Churn

The involuntary churn rate is also similar to the voluntary churn, only the reason that causes churn is different.

Involuntary churn is caused due to failure to continue the subscription due to payment failure billing issue, or issue in your payment system, or fraud detected.

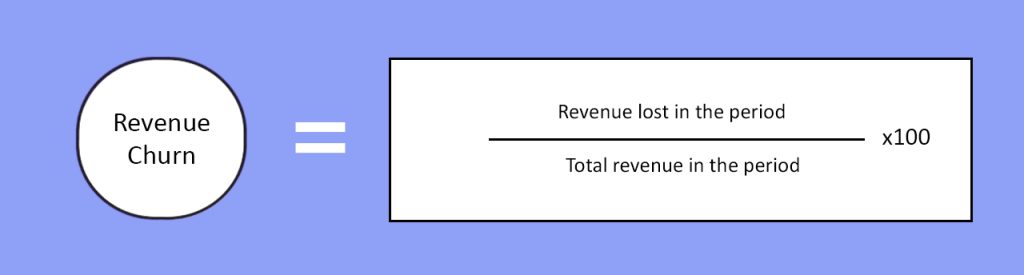

Revenue Churn

As the name suggests revenue churn is lost in the revenue due to customer churn, but it is not necessary that loss is due to the total cancellation but reduction in pay or choosing the subscription with lower value could also be the reason.

Take for example Netflix provides different variations of their subscription plan, a customer had a package of higher price say 649 plan (4 devices), but now has reduced the package to 499 plan.

The reason for a downgrade could be customers do not find the value from the amount they are spending, or no longer need the higher package.

Negative Churn

Negative Churn is kind of good news for business. The negative churn indicates the increase in cancellations but still means the revenue has increased.

The reason can be, that active members have increased the amount invested in the product or service or are buying expensive products or taken more than one subscription.

Remember for any type of Churn rate, make your follow-up game strong to understand the negative factors that lead to cancellation and understand the positive factors that make the customer become loyal to the brand.

What is a Good Churn Rate?

A ”good” churn rate totally depends on the industry business belongs and their business model.

- For a SaaS( Software as a service) business, a monthly customer churn of below 3% is considered healthy.

- For an E-commerce business customer churn can vary but anything below 5% is considered good.

- Subscription Based business models, typically see a higher customer churn, so 10% or below can be a reasonable target for them.

How to reduce the churn rate?

And the million-dollar question is- is there any way to minimize the customer churn rate? Yes, reducing customer churn is possible, it takes business to make an effort to understand why customers are leaving and make an effort to address those issues. Here are a few ways to do it :

Improve your Customer Support

A quick, helpful and friendly customer support can really make a difference. Make sure customers can reach you easily and you are able to resolve their issues promptly.

Personalize your Customer Experiences

Personalization makes customers feel valued. Personalisation can be through emails, product recommendations, or personalised offers, the aim is to make customers feel that you know them, and that way you gain their trust.

No complex Onboarding

A confusing onboarding process can take your new customers away. Make the process of understanding your product easy and get them started.

Feedback Collection and Action

Regularly ask for feedback from your customers to identify their pain points. Using surveys, reviews, and customer interactions helps you understand what’s working and what’s not.

Incentivize Customer For Long-Term Commitment

By providing discounts on an annual subscription or loyalty rewards can encourage customers to stick around for longer periods.

Why Tracking Churn Rate is Essential for Growth

The churn rate is not just a number, but it also reflects the health of your business. Here’s why tracking customer churn is important:

- To maintain the retention of customers, retaining existing customers is more cost-effective than acquiring new customers.

- To watch for revenue stability, as higher churn rates lead to revenue loss. By keeping your churn rate lower, you can experience steady revenue growth and predictable revenue.

- To help you give business insights, customer churn helps identify weaknesses in your product service or customer experience.

- To boost your confidence and look into your business potential, as lower churn means higher confidence, in longer-term success.

Conclusion

Churn rate is a key metric that tells you how well you’re retaining customers. It’s simple to calculate, but incredibly powerful in understanding business growth and customer satisfaction. Whether you’re running a SaaS company, an e-commerce store, or a subscription service, keeping an eye on the churn rate is essential.

By identifying the reasons behind churn and implementing strategies like better customer support, personalization, and effective onboarding, you can reduce churn and keep your business healthy. Remember, it’s not just about acquiring new customers—it’s about keeping the ones you already have.

Read Also: What is Customer Engagement Score? A Comprehensive Guide.

Written By – Alisha Limichana

Alisha Limichana is a seasoned growth marketer and part of the MCG team at EnR Cloud, specializing in driving business growth through innovative strategies. She has a proven track record of delivering impactful marketing campaigns. Outside of work, Alisha enjoys exploring the mountains, travelling, and staying active and fit.