Without data, understanding your customer is like making a decision based on a hunch, speculation, or universal theory. The world is full of data, acting out based on biases or false assumptions is like choosing to “turn a blind eye” to the situation.

Without data, you’re just another person with an opinion.” — W. Edwards Deming

In modern marketing, if you know what the buying behavior of your customers is, Who are your important customers? Who’s your ideal customer profile? You are one step closer to knowing your customer’s needs and preferences.

How is that possible? Using one of the most effective marketing tools: RFM analysis.

RFM analysis helps you understand your customer base better, make your campaign more customised, understand the quantitative behavior of users, and help you achieve incredible ROI.

In this article, we have talked about the meaning of RFM, the breakdown of its attributes, the questions answered by RFM, and what benefits CMOs can gain from RFM.

Table of Contents

ToggleKnow All About RFM Analysis

RFM analysis, also known as RFM, stands for recency, frequency, and monetary. RFM analysis helps you derive customer behavior insights and identify existing users who are going to stay with your business for the long term.

The main objective of RFM analysis is to identify your business’s top-layer customers and perform a targeted marketing campaign.

Breakdown of RFM Analysis:

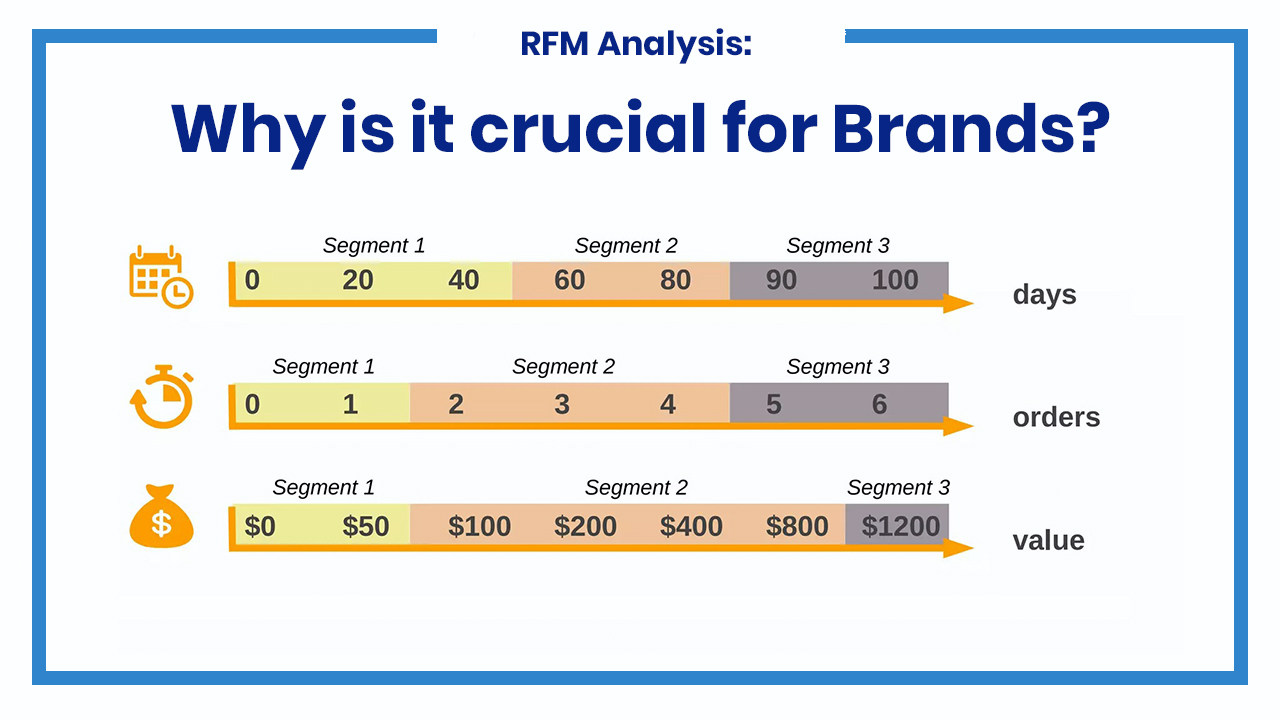

The RFM analysis is based on a scoring model, and the score is provided based on three parameters:

Recency: How recently customers has purchased from a brand. The more recent the purchase, the higher the score. It is usually measured in days.

Frequency: How often the consumer is buying the product or service of your brand. More frequent purchases secure higher scores. It is generally measured no of times.

Monetary: How much money has been spent by consumers on your brand product and services? More the money spent by the consumer, the higher the score.

Note:

This is one of the key metrics for any business if they want to gain insights into their customer behaviour. Frequency and monetary value affect a CLTV (customer lifetime value) and recency affects retention and engagement.

Steps Involved in RFM Analysis:

1- Collection of Database

Collect the data on consumer purchase history and narrow down the consumers into groups. Data can be purchase dates or the amount of each transaction.

2- Score them

After data collection, the next step is to assign scores to users on a scale of 1 to 5 for all three parameters: recency, frequency, and monetary. All three scores are combined to get the final score, which will help determine your target audience.

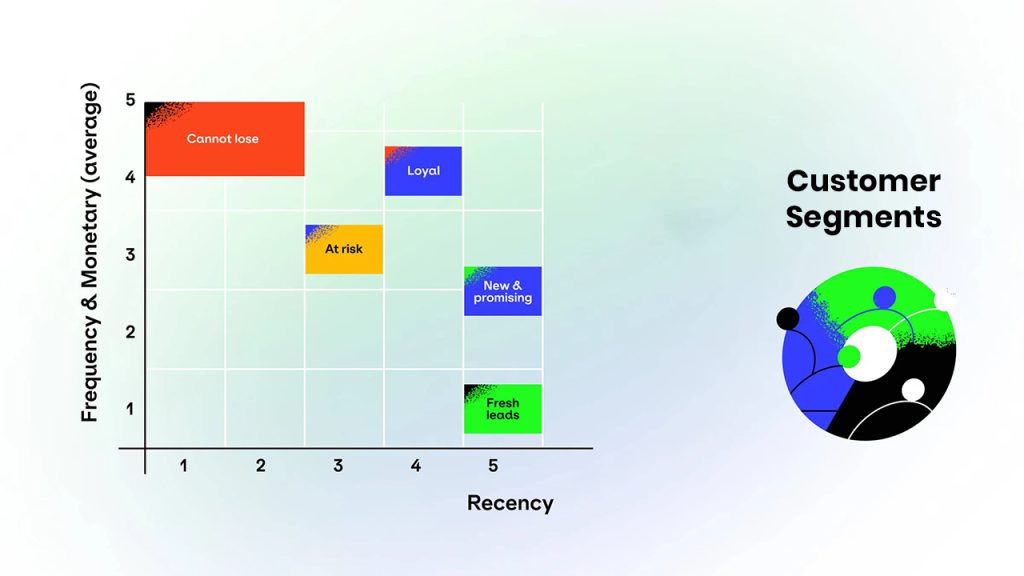

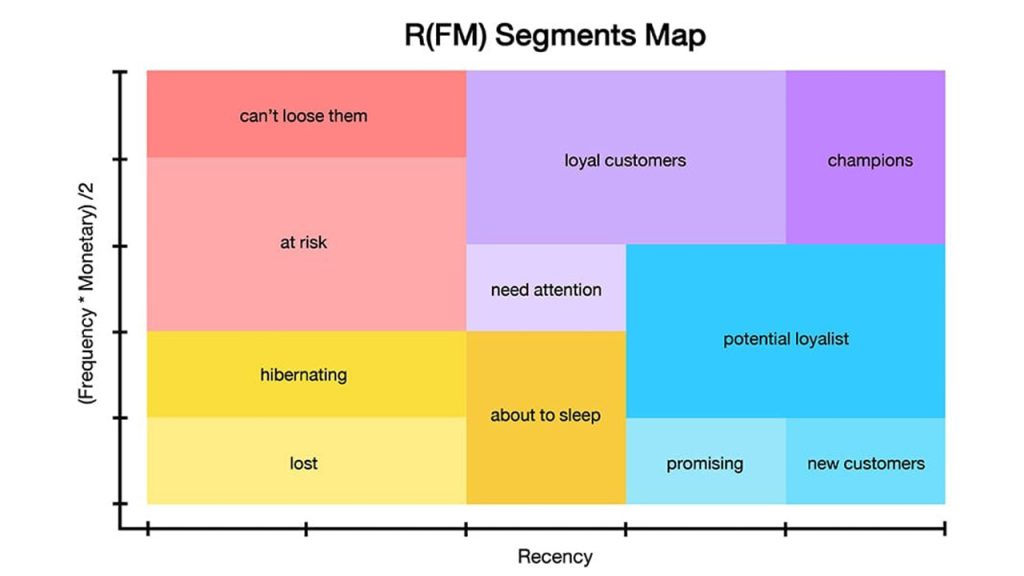

3- RFM Segmentation

Once the scoring is done, based on the scoring, group them into RFM segments. Usually, predictions need to be made based on the user’s collaboration with the brand.

For example, a customer with a 555 will fall champion or loyal customer segment. Customers with a score of 554 in RFM analysis would be grouped as potential loyal customers, and customers who have a score of 111 in all three parameters will fall under the lost RFM segment.

4- Analyse and Take Action

Understand the behavior and characteristics of users in different customer groups. Analyze all the output and the segment you have created using scoring methods. Draft the plan and implement the RFM analysis.

Explore to Get Our Martech Consultancy Services

Know All About RFM Segments

Well! The RFM segment will help you brainstorm these questions and come up with ideas on how you can provide users with what they want through their buyer journey.

Have you asked yourself these questions?

- Which customer is spending the most?

- Which customer is the most loyal, and who is returning and placing a second, third, and fourth-order?

- Which customers are new?

- Which are the customers I am about to lose?

- Which customer needs my attention?

- Which customers have I already lost?

Explore These 11 Segments in RFM Analysis

In the following article, we have grouped the segment into two parts. Let’s get into the details of the segment:

“Good-Five” Segments in RFM Analysis

1- Champion:

Finest customer and is on top among the all. Who bought recently and frequently and have spent the most money. Reward them with coupons, discounts, and the best customer service.

2- Loyal Customers:

They are the gem of your business. They spend a good amount of money and do so frequently. They will not just repeatedly purchase from you but will also talk about their great experience and send their family and friends to you. Of course, loyalty is a two-way street, so treat them with the utmost care and make them feel valued.

3- Potential Loyalist

A new customer who is in the race to become a loyal customer. They have spent more than average and done so more than once. Make them feel valuable by providing them with a loyalty program or rewards points for membership.

4- Recent Customer

Have purchased recently, but not frequently. Watch out for them, as they have a high chance of becoming potential loyalists or can drop out from a purchase cycle. Nurture them with cross-sell and up-sell, send them coupons, and plan a reward point strategy for them.

5- Promising

New customer, not spent much, likely to be their first purchase, but expensive one. Potential repurchase. Make educational content or a good up-sell offer for them and start building relationships with them.

The “Stubborn” Six Segments in RFM Analysis

6- Need Attention

They have spent a good amount of money. Bought frequency. Has stopped buying recently. Go back and investigate the reason behind no purchase in recent times and find a way to bring them back through trust and any personalized and customized communication.

7- About to Sleep

The customer whom you might lose soon. They are below average in all three parameters. Not purchased for a long time. Don’t leave them hanging, try to bring them back by making the last effort to communicate with them with the most relevant message.

8- At Risk

No recent purchase. Used to spend a lot and frequently. They are on the verge of ending their relationship with you. If not taken care of, they are very likely to be lost.

9- Can’t Lose Them

It is similar to “At Risk,” but the scoring is lower for all three parameters. There might be a few reasons like price sensitivity, no new promo code or discount code received. Dig in and find out what went wrong, and don’t lose them to your competitors.

10- Hibernating

Users haven’t been back for a long time; they spend very little and very rarely. Tempt them to re-purchase as soon as possible; if not, the brand will lose both the customer and trust.

11- Lost

What gone is gone. They have the lowest score of all. No more shopping from brands; and already went for alternative choices. It is next to impossible to re-engage with them, and they have already formed a negative brand image.

Benefits of RFM Analysis to CMOs

1- Targeted Marketing Campaign

With the help of the RFM analysis, marketers like you can create successful personalised marketing strategies specific to each customer segment. It will help identify the target audience, and help you spend wisely. Identifying the target audience means marketing and promoting to those who are already interested in your brand product and services.

2- Customer Segmentation

RFM analysis can help you identify different customer groups based on their buying behaviour, and how it will impact your business. The segmentation can be an indicator of whether the customer is the hot lead or the cold lead, or whether the customer is staying with the brand or is churning out.

3- Engagement and Retention

RFM analysis can help you boost your relationship with your customers by increasing engagement and customer loyalty. RFM also helps you understand customer behaviour which enables you to design better retention strategies.

4- Cost-Effective

RFM analysis implementation can reduce the overall marketing expenses of a business by focusing more on targeted campaigns. A targeted campaign can lead to higher conversion rates and higher revenue from high-value customers.

Final Thoughts:–

To conclude, RFM analysis supports the popular marketing adage, “80% of business comes from 20% of the customer.”

RFM, as a marketing analytical tool, helps CMOs identify the best customers based on their spending habits. This enables CMOs to boost their marketing and promotional campaigns.

RFM says instead of treating all customers the same, which might result in lower customer retention, focus on customers who have chances of coming back because they are the most valuable customer segment.

As a marketer, you have an idea about data-driven insights, but RFM analysis is easier said than done.

Get in touch with us to unlock the potential of your customer data today!

Also Read- What is the Customer Engagement Score? A Comprehensive Guide

Alisha Limichana is a seasoned growth marketer and part of the MCG team at EnR Cloud, specializing in driving business growth through innovative strategies. She has a proven track record of delivering impactful marketing campaigns. Outside of work, Alisha enjoys exploring the mountains, travelling, and staying active and fit.