Loyal customers are super important for any business. They keep coming back, spend more money, and even tell their friends about the brand. But how do you know if your customers are really loyal?

You need to measure it! This is why customer loyalty metrics like NPS, retention rate, and repeat purchase rate can help you. These simple numbers help businesses see what’s working and what needs to get better.

Read on to understand 7 easy ways to measure customer loyalty and how businesses can use them to keep their customers happy and coming back for more.

Table of Contents

ToggleLoyalty in 7 Simple Metrics

NPS Metrics

NPS metrics is kind of a straightforward way to gauge customer satisfaction and loyalty. NPS ask one essential question, without annoying the customer with a long list of questions. NPS measures how likely customers are to recommend your brands to others. The customer answers the question by giving a value of between 1 and 10, which further divides the customer into 3 categories:

1. Promoters: Loyal customers who actively promote your business. Score between (9-10) consider promoters

2. Passives: Satisfied but not enthusiastic customers. ( 7-8)

3. Detractors: These customers who score 6 or less. Unhappy customers who may discourage others.

NPS is important as it helps you identify your most loyal customers and areas where you need to improve. The higher the NPS, the higher the chances of a customer being an advocate of your brand. Stats say a company with an NPS of 70% has significantly more promoters than detractors, showcasing higher customer satisfaction.

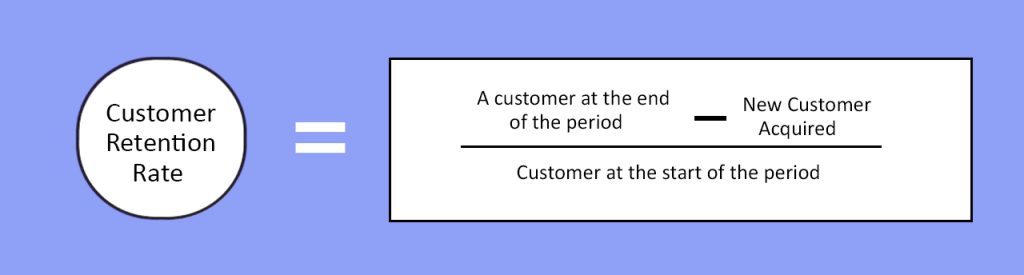

Customer Retention Rate (CRR)

Customer Retention Rate, or CRR, is the percentage of customers retained by any business during a specific period. This defines retention efficiency in terms of how well a company keeps its customers coming back for business instead of losing them to competitors. Plainly put, it refers to how well you maintain your relationships with customers.

How to Calculate Customer Retention Rate?

The formula for calculating CRR is straightforward:

A high retention rate shows that your customers are happy and that your efforts to maintain relationships are paying off. For instance, companies like Amazon focus on retention through fast shipping and personalized recommendations, keeping their CRR exceptionally high.

Brands can improve Customer Retention Rates by providing excellent customer service and also personalized experiences and rewarding loyal customers.

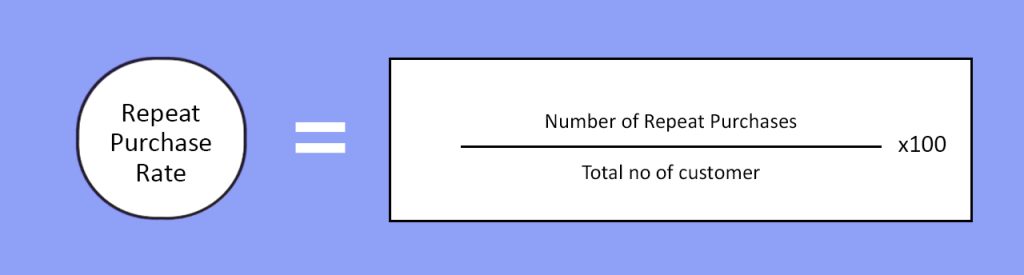

Repeat Purchase Rate (RPR)

Repeat Purchase Rate (RPR) is a metric reflecting the percentage of customers who make more than one purchase over time. It is a significant indicator of customer loyalty and satisfaction, as it tells how well a business does when it comes to retaining customers and encouraging them to make purchases again.

How to Calculate Repeat Purchase Rate?

The formula to calculate RPR is :

Repeat purchases are a clear sign of loyalty. Customers coming back to you is a sign that they trust your brand and see value in what they have purchased from you. According to research, increasing customer retention by just 5% can boost profits by 25-95%

The repeat purchase rate can be improved with points, discounts, coupons, and by engaging with customers after their purchase to cross-sell and up-sell.

The industry benchmark can vary across industries, say for an e-commerce brand a Repeat purchase rate is considered healthy. For the subscription-based model higher RPRs, which exceed 50% are due to recurring purchases. For retail business RPR ranges between 20-30 % depending on the type of product.

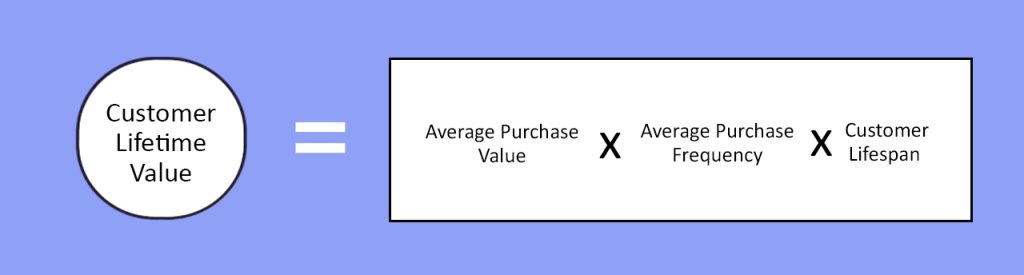

CLTV (Customer Lifetime Value)

Customer Lifetime Value metrics are used to measure customer loyalty which helps measure the total revenue a single customer spends on a brand throughout their entire lifetime with the company. It gives you insights into the long-term value of retaining customers and helps businesses make good strategies to maximize profit.

How to calculate CLTV?

The formula for Customer Lifetime Value (CLTV) can vary based on business models, but a common approach is:

Where:

- Average Purchase Value = Total revenue generated / Total purchases

- Average Purchase Frequency = Total purchases / Total customers

- Customer Lifespan = Average time (in months or years) a customer stays with the business

Higher CLTV indicates that your customers are loyal towards your brand and are consistently contributing to your revenue. A business is considered healthy when it aims for a CLTV-to-CAC ratio of 3:1, which means the lifetime value should be three times higher than the cost of acquiring a customer.

Customer Loyalty Index

Unlike standalone metrics like NPS or customer retention rate, the Customer loyalty index measures loyalty on a broader scale by taking into consideration three important aspects of consumer behavior, which are:

- The customer’s willingness to recommend your brand ( using NPS)

- The frequency of repeat purchase

- Their desire to purchase additional products or upgrade ( upselling and cross-selling)

Combining all these factors will give a deeper understanding of customer loyalty by examining consumer advocacy, behavior and spending patterns.

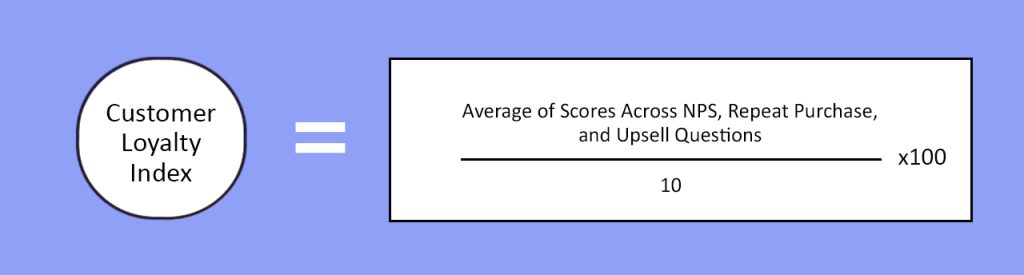

How to measure the Customer Loyalty Index?

Calculating this customer loyalty measure involves collecting data from a structured customer survey that includes questions focused on these loyalty dimensions:

- Recommendation (NPS): “How likely are you to recommend our brand to others?”

- Repeat Purchases: “How often do you make repeat purchases with us?”

- Upselling Interest: “How likely are you to try our additional products or services?”

Customers respond to these questions on a scale (e.g., 1–10), and their answers are averaged to create the CLI.

For example:

- NPS score = 8

- Repeat purchase score = 7

- Upselling interest score = 9

CLI= ((8+7+9) /30)×100 = 80%

This indicates an 80% loyalty index, suggesting that most customers are loyal and engaged.

The customer Loyalty Index gives you a holistic view of loyalty and helps you identify weaknesses (eg. low NPS or upselling interest) in the area that needs attention.

Upsell and cross-sell

One of the important customer loyalty metrics is measuring the success rate of Upsell and Cross-sell.

Upsell and Cross-sell are the key metrics that measure, how effectively a business encourages the customer to buy higher-value products (upselling) or additional products and services (cross-selling).

These rates give you insights into how well you are utilizing the potential of the customer

What are Upselling and Cross-Selling?

1. Upselling: When you persuade customers to purchase a product that is the premium version of the product purchased.

Example: Suggesting a better higher-tier subscription plan after a purchase of the basic plan.

2. Cross-selling: When customers are encouraged to buy complementary products or services.

Example: Suggesting a phone case or earphones with a new smartphone purchase.

Both strategies aim to increase customer satisfaction by addressing more of their needs while increasing the company’s revenue.

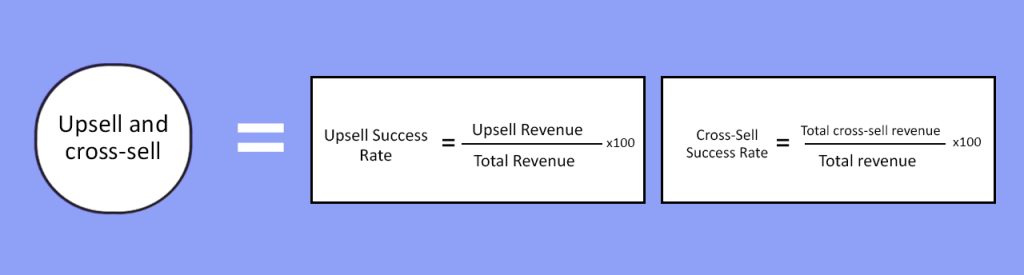

How to Measure Upsell and Cross-Sell Success Rates

The formulas for these metrics are straightforward:

Example Calculation:

Total Transactions: 1,000

Upsell Transactions: 200

Cross-Sell Transactions: 150

Upsell Success Rate: 20%

Cross-Sell Success Rate:15%

This means 20% of your transactions involved upselling, and 15% included cross-selling.

Upselling and cross-selling directly increase the AOV and overall revenue of the business, which leads to customer satisfaction and customer retention.

To improve the upselling and cross-selling you can use customer data to recommend relevant products and services. You can also create a product bundle that encourages customers to buy more.

According to industry benchmarks,

- E-commerce: Upsell rates range between 10-30%, while cross-sell rates typically fall between 5-15%.

- SaaS: Companies see higher upsell success rates, often exceeding 30%, due to subscription upgrades.

- Retail: Cross-sell rates average around 10-15%, especially with well-curated product bundles.

What is the Referral Rate?

The Referral Rate quantifies the percentage of your existing customer base that actively contributes to bringing in new customers. A higher referral rate suggests a strong word-of-mouth network, which is one of the most cost-effective and trusted forms of marketing.

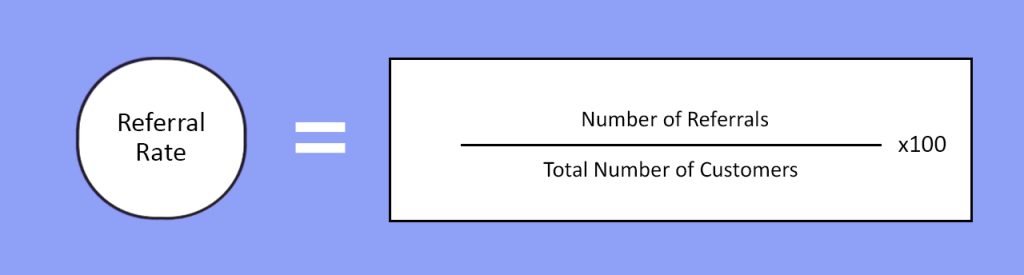

How to Calculate Referral Rate

The formula for the Referral Rate is simple:

- Number of Referrals: The total number of new customers who joined through a referral program or were directly referred by existing customers.

- Total Number of Customers: The total active customer base during the same time period.

Example Calculation

Let’s say:

- You have 1,000 active customers.

- 200 new customers joined via referrals.

Referral Rate=(200/1000)×100= 20%

This means that 20% of your customers are actively referring others to your business.

Referral rate plays an important role in customer satisfaction, as happy customers are more likely to refer to others, making referral rate a direct measure of satisfaction. Also, referrals are often free or low-cost growth tools, saving big time on expensive customer acquisition strategies.

To improve customer referral rates, brands can offer incentives like discounts, rewards, or freebies to customers when refer others.

Important benchmark as per industry:

- E-commerce: Average referral rates typically range between 5–10%, with well-executed programs reaching up to 20%.

- SaaS: Referral rates can exceed 15%, especially for businesses with strong product-market fit.

- Retail: Referral rates often hover around 10%, depending on customer loyalty and satisfaction levels.

Conclusion

Measuring customer loyalty is like figuring out what makes your friends stick around. Metrics like NPS, repeat purchases, and referrals help businesses understand what their customers love and what could be better. By paying attention to these numbers, businesses can keep their customers happy, make them feel special, and get them to stay longer.

The lesson? Keep an eye on what matters, fix what’s broken, and show customers you care. Loyal customers will keep coming back and help your business grow!

Happy Reading 😊

Read Also: Average Order Value: Effective ways to increase it!

Written By – Alisha Limichana

Alisha Limichana is a seasoned growth marketer and part of the MCG team at EnR Cloud, specializing in driving business growth through innovative strategies. She has a proven track record of delivering impactful marketing campaigns. Outside of work, Alisha enjoys exploring the mountains, travelling, and staying active and fit.